Story highlights

"I described it earlier as a bumpy ride," Thune said

The Senate voted along party lines 52-48 to start a full debate

The Republican Party finally has the wind at its back on tax reform.

Starved of a significant legislative win for 10 long months since President Donald Trump took office, GOP senators are within touching distance of passing the most sweeping reform of the tax code for 30 years.

A final vote on passing the bill, a version of which has already trekked through the House, is expected late on Thursday or Friday – if the fragile Republican coalition can hold together despite last-minute anxiety over the final shape of the legislation and its long-term political and economic implications.

“I described it earlier as a bumpy ride,” Republican Sen. John Thune of South Dakota told CNN’s Dana Bash in an interview on Wednesday. “Now we have to land the plane. And I’m hoping that by the end of the week we’ll have the votes to do that.”

A day after surviving a near-death experience in the Senate Budget Committee, the bill on Wednesday vaulted another obstacle, as the Senate voted along party lines 52-48 to start a full debate on the proposed new law.

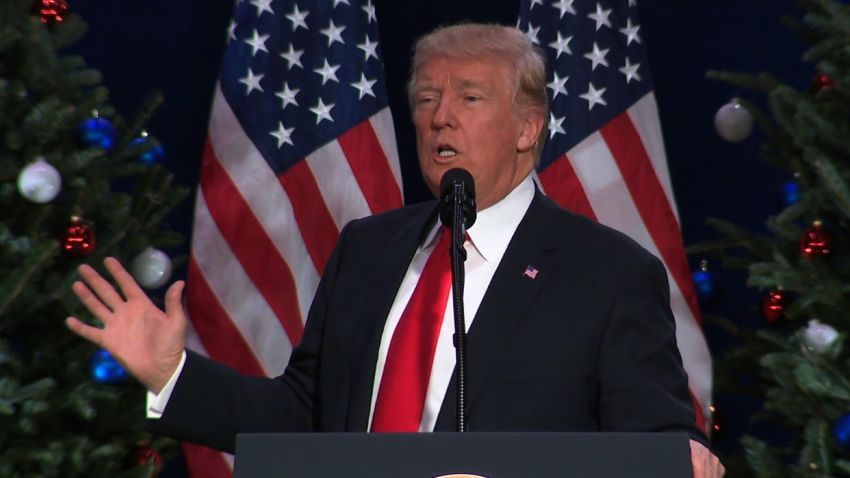

Trump, seeking a long-awaited victory to salvage a disappointing first year in office and surrounded by another tsunami of controversy of his own making on Wednesday, was already gearing up for the celebrations.

“A vote to cut taxes is a vote to put America first again. We want to do that,” Trump said, promising a “big, beautiful Christmas present” that will help middle-class families and create jobs.

Many independent studies, however, have found that the Republican bill will overwhelmingly benefit corporations and the rich, and will see tax cuts for individuals expire over the life of the legislation.

Though Wednesday’s vote suggested growing momentum for the GOP’s bid to rush the bill through and sideline Democratic opposition and wavering senators on its own bench, there are no guarantees that the party’s fragile majority will hold over the tense coming hours of amendments and debate.

The vote of Sen. Bob Corker, R-Tennessee, for instance, may hinge on the retention of a trigger mechanism that would raise taxes again if the legislation’s promised economic growth spurt does not take place.

Some conservatives are wary of the plan on principle. Others worry that the move could result in the hiking of taxes during any future recession in a way that would make the economic picture even worse.

But there are also signs that given the importance of handing frustrated GOP voters a victory ahead of midterm elections in 2018, party senators may eventually conclude not to get overly hung up on details. The political debacle that unfolded after the party’s failure to repeal Obamacare is fresh in many minds.

Senate Majority Leader Mitch McConnell can afford to lose no more than two votes on his side to pass the bill. Several GOP senators, including Susan Collins of Maine, Lisa Murkowski of Alaska and John McCain of Arizona, have yet to say how they will vote. Collins and Murkowski have shown signs, however, that they are moving towards the ‘yes’ column, especially following Trump’s intervention during a trip up to Capitol Hill on Tuesday.

If the bill passes the Senate, it is likely to face new hurdles as it must be reconciled with the House version of the legislation before final votes and what will likely be a huge fanfare when it is signed by Trump.

Democrats are raging at the GOP’s attempt to push the bill though the Senate quickly, in what Sen. Ron Wyden of Oregon called a “mad dash.” They are condemning provisions that wipe out the individual mandate – a pillar of Obamacare, which they say will deprive millions of people of coverage and raise health care costs for others.

“Take it all together, it is an immense amount of money being taken from people who are already walking an economic tightrope,” Wyden said.

But increasingly, Democrats appear to be testing out arguments that will frame the narrative of the tax bill once it is in effect, in the run-up to the midterm elections, rather than raising alarm with any hope of ultimately halting the bill’s passage.